D-Market, $HEPS Hepsiburada, the #3 eCommerce marketplace in Turkey, is going public on Jun 30th, seeking to raise $680M at $3.9B Market cap. The company did $2.4B in GMV and $751M in revenue growing at over 100% YoY.

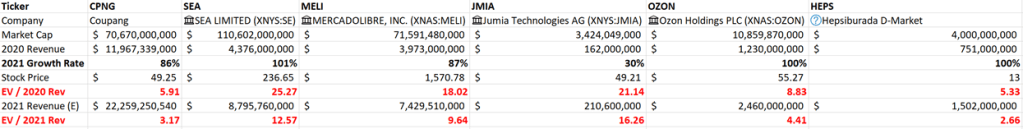

$HEPS is selling 41.67M shares at $13. In terms of valuation, they are the lowest of the entire regional eCommerce companies and much better than $OZON or $CPNG from a valuation and growth standpoint.

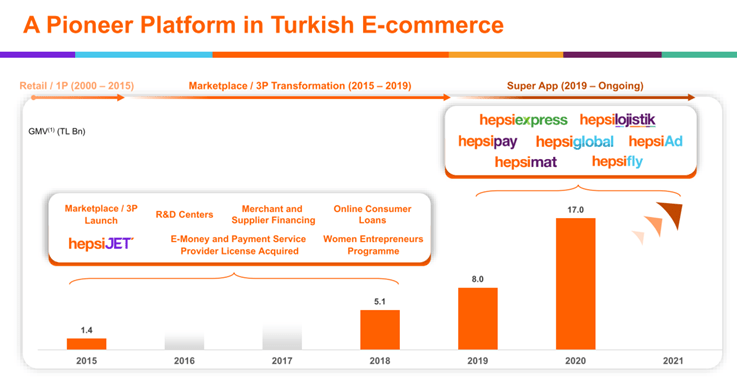

$HEPS makes 43% gross margins and like most eCommerce companies is branching into logistics, payments and local delivery. They aim to be a super app in Turkey.

Turkey is not a very large market with $60B in eCommerce and $250B Retail, but it has 24% penetration of eCommerce and growing. Compared to Turkey, $CPNG operates in South Korea with a $543B Retail market.

Hepsiburada is actually #3 in the market (although they claim to be #2 by some metrics). Trendyol.com and sahibinden.com are the largest 2 players.

I think the stock will do well given the valuation metrics. It is valued lower than comparable players, is growing quickly and has a little attention from retail and wall street.

I am yet to make up my mind on if I I will take a position at the IPO.

Risks: Small TAM (Turkey alone), Regional and political issues (similar to $OZON) and a number 3 player in a small market.

Discover more from Mukund Mohan

Subscribe to get the latest posts sent to your email.