Most everyone has probably heard of or seen the Awareness & Knowledge 2X2 matrix. Often quoted, the “unknown unknows” are the ones that are said to be the cause a lot of angst.

Lets say you work at a startup in the Silicon Valley (SV). And you know about Silicon Valley Bank (SVB). It is the “banker to the startups”.

Most startups have their first checking account with SVB and continue to maintain that relationship as the grow, since they offer Venture Debt, Line of Credit and other products that most “mainstream” banks wont offer to SV startups.

You may also know that all banks make money by lending money at a higher interest rate than the rate the pay for their deposits. The difference is their revenue or “Net Interest Income”.

In 2020-2021 deposits for SVB grew significantly. From about $69 Billion to $189 Billion.

SVB, like most other banks, has to now “invest” that money into safe deposits – treasuries paying a low rate in 2021.

Fast forward to today and the rates are MUCH higher. Fed rates went up too high, too quick.

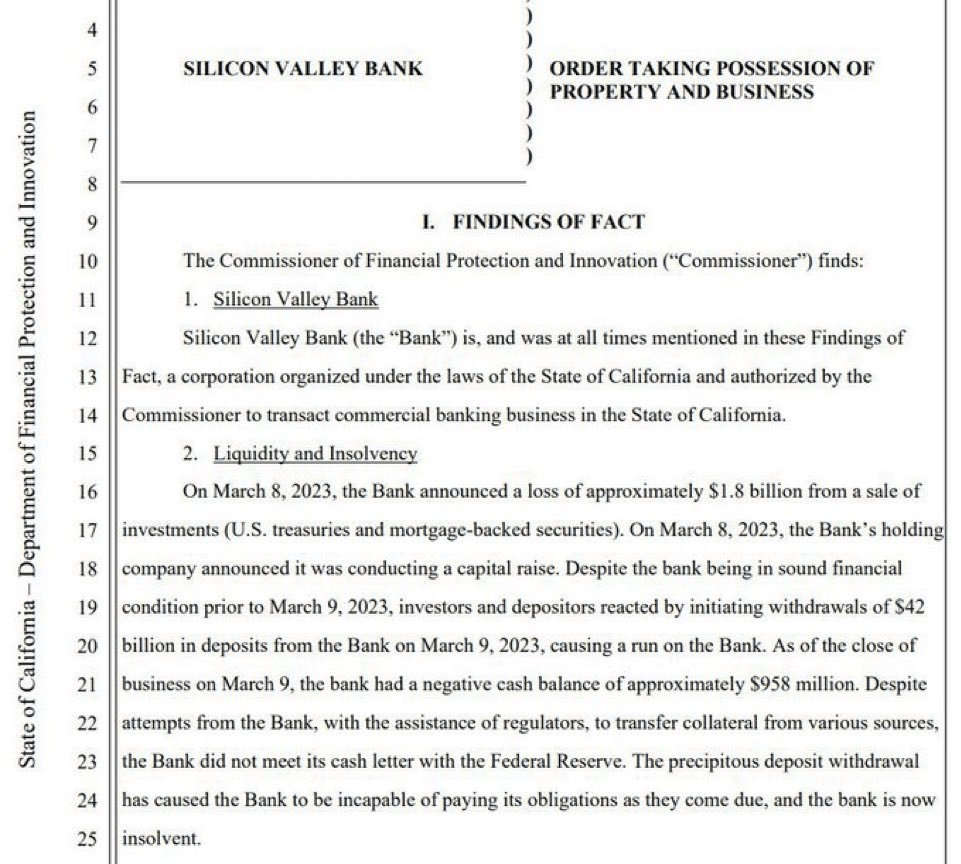

So the “safe investments” that SVB had in treasuries are now not worth as much any more. In fact they decided to take a loss of $1.8B. Which is a very small amount of money relative to their deposits.

To cover for those losses they were planning to sell stock to the tune of $2.5B.

Some account owners decided to withdraw their money from SVB – “To be safe”. That created a panic – called a Bank Run.

Well it turns out a lot of startups pulled money out of the bank. $42 Billion to be exact. Many startup founders mentioned their venture investors suggested they do it.

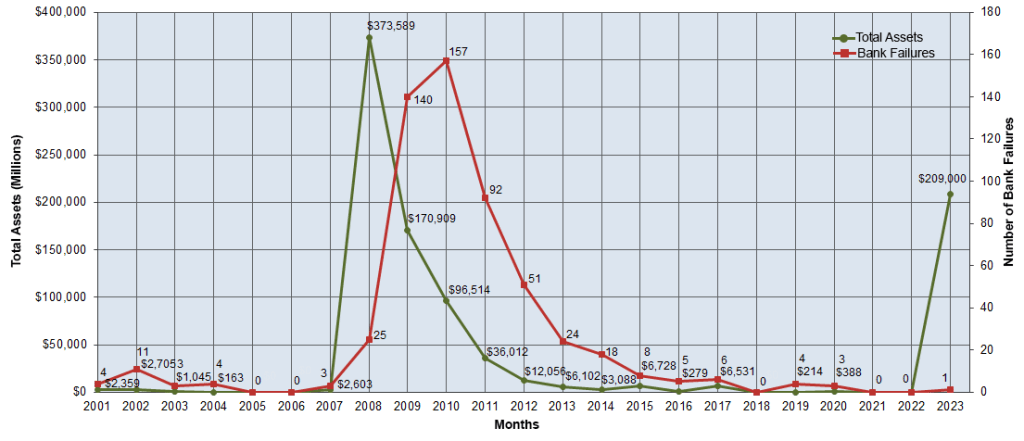

Thanks to the bank run, today, FDIC decided to fold SVB, which means every account with < $250K ( federal deposit insurance limit), is clear but those with higher deposits (92% of accounts) are stuck. Why did the FDIC do that? That’s because SVB no longer had funds to support the bank run.

But, those companies who raised a lot of money and kept it “safely” in SVB, will have to wait until after Monday when FDIC will find a new mechanism to get them the money.

You are still a startup employee, whose company has an account with SVB.

You did not know the exposure to bonds would now create a miss to your paycheck next month. Hopefully FDIC finds a buyer for SVB and keeps the entire bank “alive” – on Monday.

Historically, however from FDIC, “most bank failures for non-insured accounts got back 10 cents to 20 cents on the dollar deposited”.

In the last 2 days their stock has taken a big beating (down 60% in day 1 and another 60% day 2).

What you dont know.

Discover more from Mukund Mohan

Subscribe to get the latest posts sent to your email.