As SaaS and AI-native companies evolve, so do their monetization needs.

Gone are the days when simple subscription billing could handle the complexities of a modern B2B company. Today’s growth-stage businesses demand flexible usage-based billing, automated revenue workflows, and AI-enhanced pricing logic to remain competitive. A wave of startups—and some mature players—are rising to meet this demand, redefining the core of how software companies generate and optimize revenue.

In this post, we break down the emerging landscape of modern revenue infrastructure by analyzing 9 standout companies: Metronome, Orb, Maxio, Paid.ai, Solvimon, Zenskar, PostHog, Sequence, and Paddle.

The Shift from Legacy Billing to Composable Monetization

Traditional billing platforms like Zuora or Chargebee were built in the era of flat subscriptions and manual workflows. But the modern SaaS business is:

- Product-led (PLG), requiring granular metering of user behavior

- Global, with currency, tax, and compliance complexity

- Modular, offering hybrid pricing (seats + usage + features)

- AI-driven, where dynamic pricing and renewals must be handled in real-time

Enter the new monetization stack—an ecosystem of tools built API-first, designed for developers and RevOps teams alike.

Segmenting the Landscape: Four Clusters

To make sense of this rapidly growing market, we segmented the companies into four distinct clusters:

1. Usage-Based Billing Platforms

These tools provide powerful metering, real-time billing, and pricing flexibility:

- Metronome: Built for scale, Metronome is known for its developer-friendly APIs and real-time metering. Used by fast-growing SaaS businesses embracing usage-based pricing.

- Orb: A strong choice for AI-native companies needing composable pricing logic and deep integrations.

- Zenskar: Focuses on quote-to-cash and supporting hybrid pricing models.

- Solvimon: Based in Europe, it supports sophisticated pricing rules for fintech and B2B software businesses.

- Sequence: Positioned as a CPQ+Billing hybrid, with strong RevOps and approval workflows.

These platforms are ideal for high-growth SaaS teams that need precise control over how they bill based on real usage.

2. RevOps / FinOps Infrastructure

These platforms extend billing into revenue recognition, SaaS metrics, and compliance:

- Maxio: A well-established name for financial operations, including deferred revenue and subscription analytics.

- Paddle: Operates as a Merchant of Record, handling tax, fraud, payments, and compliance globally.

They’re especially suited for finance teams looking to unify monetization with compliance and reporting.

3. AI-Native Billing

This emerging category blends dynamic logic with automation:

- Paid.ai: A newer player that acts as the brain of the revenue engine—handling renewals, pricing decisions, and billing using AI agents.

Perfect for experimental teams looking to future-proof their revenue stack.

4. Product Analytics Adjacent

These aren’t billing tools per se—but they inform monetization strategy:

- PostHog: An open-source product analytics suite that helps companies understand usage patterns, retention, and conversion—crucial for pricing and packaging decisions.

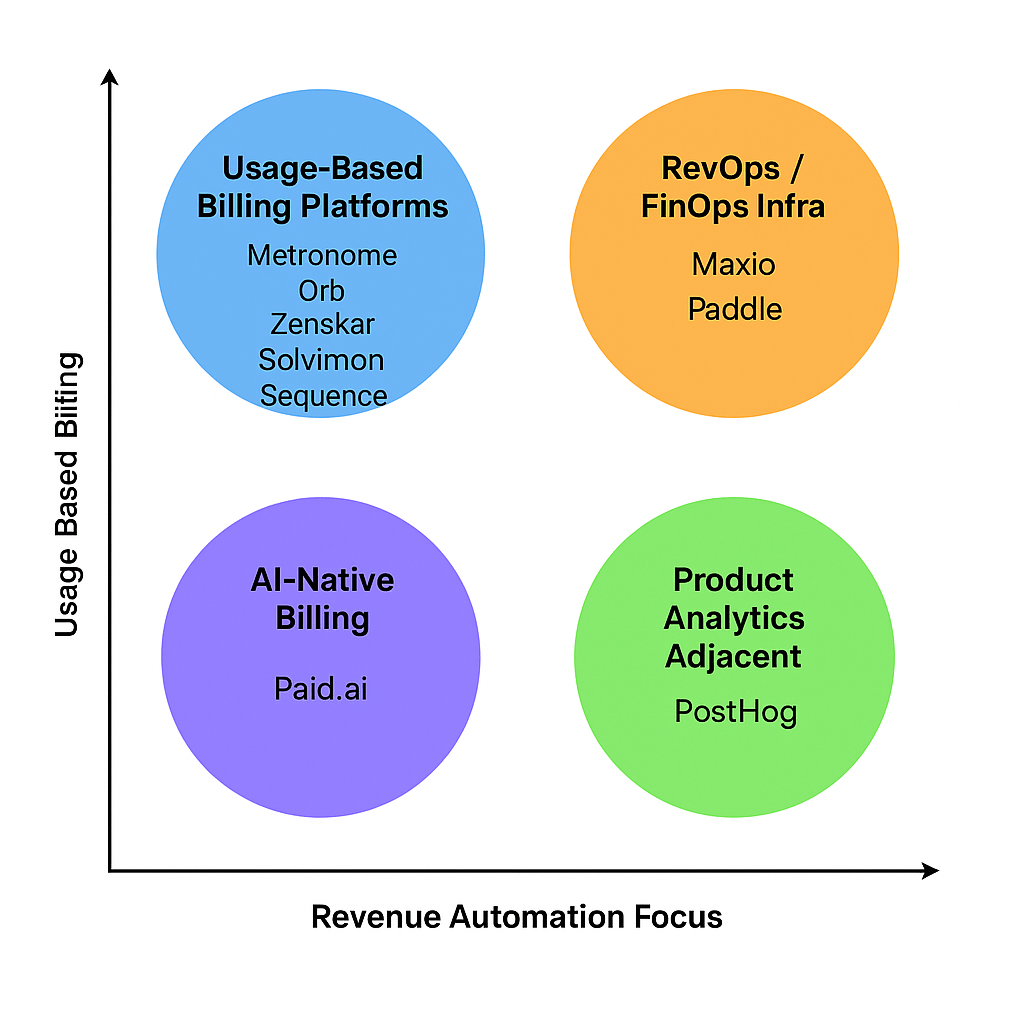

Visualizing the Landscape

In our quadrant view, we plotted these companies along two axes:

- X-axis: Revenue Automation Focus (manual vs automated workflows)

- Y-axis: Usage-Based Billing Sophistication (flat rate vs dynamic pricing)

Each cluster reflects a different strategy for monetizing software:

- Usage-billing companies dominate the top-left, prioritizing granular metering.

- RevOps tools cluster top-right, integrating compliance and finance.

- AI-native and analytics platforms fill in the bottom quadrants, each pushing innovation.

Who Should Use What?

| Company Profile | Ideal Cluster |

|---|---|

| Early-stage PLG SaaS | PostHog, Metronome |

| Scaling SaaS with hybrid pricing | Orb, Zenskar, Sequence |

| Global SaaS needing tax/compliance | Paddle, Maxio |

| AI-native or dynamic pricing | Paid.ai |

Looking Ahead

The lines between billing, finance, and product analytics are blurring. As GTM teams embrace more complex monetization strategies, the most successful platforms will be:

- Composable: Integrating across CRM, data warehouse, and product systems

- Real-time: Offering instant billing, pricing, and reporting

- AI-native: Making predictive decisions on renewals, discounts, and pricing

These 9 companies are at the forefront of this transition. As the market matures, expect convergence—and consolidation—as businesses look for unified monetization platforms.

As B2B software moves from seat based or usage based pricing to outcome based pricing these companies are the new backbone behind many of the new AI startups.

They specialize in recurring revenue models, usage-based billing, or quote-to-cash processes. Their products go beyond billing to include features like revenue recognition, analytics, forecasting, and reporting.

Most platforms provide robust APIs or developer-centric tooling to integrate into existing SaaS stacks. They focus on infrastructure needed after a sale: invoicing, tax compliance, dunning, renewals, etc. These companies are part of an emerging wave disrupting legacy billing systems like Zuora, Aria, or Chargebee.

| Company Name | Founding Year | Number of Employees | Key Products |

|---|---|---|---|

| Metronome | 2019 | 130 | Usage-based billing platform for SaaS companies. |

| Orb | 2021 | 72 | Modern billing infrastructure for AI and software companies. |

| Maxio | 2009 | 235 | Billing and financial operations platform for B2B SaaS, including subscription management and revenue recognition. |

| Paid.ai | 2024 | 9 | Business engine for AI agents handling pricing, subscriptions, margins, billing, and renewals. |

| Solvimon | 2022 | 18 | Monetization and billing automation platform for global fintech and B2B software businesses. |

| Zenskar | 2022 | 64 | Quote-to-cash platform automating complex subscription and usage-based billing with analytics. |

| PostHog | 2020 | 85 | Open-source product analytics and data toolkit used by over 70,000 teams. |

| Sequence | 2021 | 30 | Modern billing, CPQ, and revenue recognition platform for error-free revenue workflows. |

| Paddle | 2012 | 360 | Merchant of record solution for SaaS businesses, handling payments, tax, and subscription management. |

Cluster 1: Usage-Based Billing Platforms (Modern Monetization Engines)

These platforms focus on complex, usage-based pricing and billing infrastructure, aimed at modern SaaS and AI-first companies.

| Company | Focus Area |

|---|---|

| Metronome | Scalable, developer-first usage-based billing |

| Orb | AI and usage billing with strong API integrations |

| Zenskar | Flexible quote-to-cash with metered and hybrid billing |

| Solvimon | Tailored billing logic for global B2B and fintech companies |

| Sequence | Workflow-heavy CPQ + billing for RevOps & finance teams |

These are often picked by fast-scaling PLG companies needing metering, pricing flexibility, and integrations with engineering systems.

Cluster 2: Financial Operations / Revenue Automation Platforms

These companies wrap billing with RevOps, collections, revenue recognition, and SaaS metrics.

| Company | Focus Area |

|---|---|

| Maxio | Subscription + revenue recognition + SaaS metrics |

| Paddle | Merchant of record for global SaaS (incl. tax, fraud, compliance) |

They often replace both Stripe + Chargebee + RevOps tooling in small to mid-market SaaS companies.

Cluster 3: Intelligent Billing with AI Agents or No-Code Logic

These are early entrants using AI and automation for smarter billing or decision-making.

| Company | Focus Area |

|---|---|

| Paid.ai | AI-powered revenue engine—dynamic pricing, subscriptions, renewals |

This space is still maturing, but Paid is positioning for an AI-native finance stack.

Cluster 4: Product Analytics + Monetization Intelligence

These aren’t pure billing players but sit adjacent to monetization with a product-led GTM lens.

| Company | Focus Area |

|---|---|

| PostHog | Open-source product analytics platform (user behavior, retention, funnels) |

PostHog isn’t a billing platform, but helps inform pricing/packaging and user engagement loops that affect monetization.