Tag Archives: investing

Should you use $GOOGL google bard or ChatGPT for stock screening?

Apple $AAPL services revenue is something to watch for this quarter

Apple’s Services revenue comprises a variety of different products and services, including:

- The App Store

- Apple Music

- Apple Arcade

- Apple TV+

- iCloud

- Apple Pay

- Apple Card

- Apple News+

- Apple Fitness+

- Apple Books

- Apple Care+

These services are available to Apple customers around the world and are a key part of Apple’s overall business strategy.

As you can see, Apple’s services revenue has been growing steadily over the past few years. In the most recent quarter, Apple’s services revenue grew by 6.4% year-over-year.

I am watching growth from $AAPL card and fitness+ for future growth as Apple Mac sales slow down.

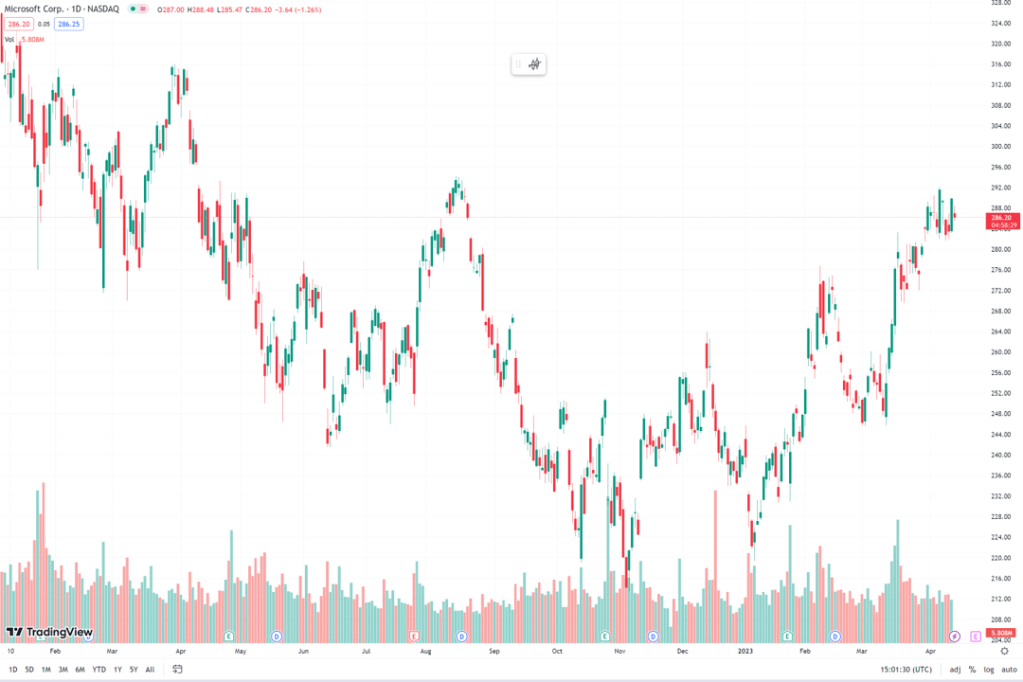

How to trade $MSFT earnings (backtesting Microsoft trades for 12 quarters)

The reliable Microsoft trade is as predictable as it comes.

Microsoft will announce earnings on April 25th 2023.

Here is a table with Microsoft revenue and earnings growth over the last 12 quarter. With the stock performance a day and week after earnings.

What is consistent is the 1.01% to 1.42% rise a week after earnings with a 0.35% standard deviation.

Should I trade $AAPL Apple before earnings? What does backtesting show?

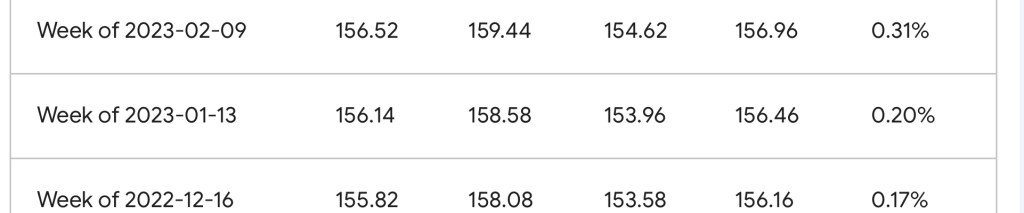

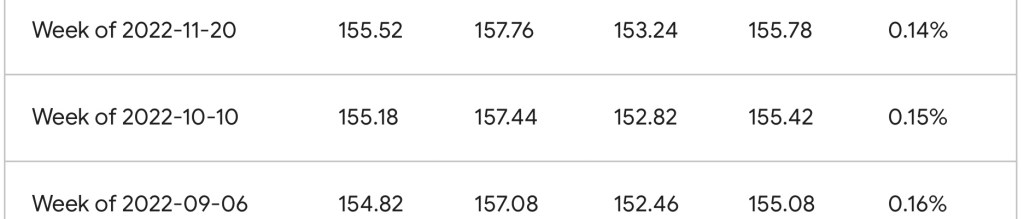

Here is a summary of Apple stock performance for each week before their last 12 earnings reports:

As you can see, Apple stock has generally trended upwards over the past year, with only a few minor dips. The average change in stock price over the past 12 weeks is 0.17%

Backtesting $AAPL Apple trade before and after earnings using Trading View @tradingview

Let’s say you want to find a trade for Apple after and before earnings. How can you do it?

Here is a step-by-step plan to backtest an Apple trade before and after earnings on TradingView using 2-week increments of historical stock prices for 20 quarters:

- Log in to TradingView and select the chart for Apple’s stock (AAPL).

- Click on the “Settings” icon in the top toolbar and select “Interval” from the dropdown menu. Set the interval to “2 weeks” to ensure that the chart displays historical data in 2-week increments.

- Click on the “Data” icon in the top toolbar and select “Load Data” from the dropdown menu.

- In the “Load Data” dialog box, select “Historical Data” and set the date range to cover the past 20 quarters of Apple’s earnings releases.

- Once you have loaded the historical data, click on the “Strategy Tester” icon in the top toolbar to open the backtesting panel.

- In the backtesting panel, select “AAPL” as the instrument and set the date range to cover the same time period as the historical data you just loaded.

- Define your trading strategy. For example, you may want to buy AAPL stock two weeks before each earnings release and sell it two weeks after the release. You can define this strategy using TradingView’s simple point-and-click interface.

- After defining your strategy, click on the “Start Testing” button to begin the backtest.

- Once the backtest is complete, review the results. TradingView provides a range of performance metrics, including total return, Sharpe ratio, and drawdown. Analyze these metrics to determine the effectiveness of your strategy.

What is backtesting? How can I do backtesting?

Backtesting is a technique to evaluate the performance of an investment strategy or trading algorithm.

The process involves testing the strategy or algorithm against historical data to determine how it would have performed in past market conditions.

The goal of backtesting is to determine whether a particular investment strategy or trading algorithm would have been profitable in the past, and to use this information to make informed decisions about future investments.

By analyzing the historical performance of a strategy or algorithm, investors can gain insights into its strengths and weaknesses, and make adjustments as needed to improve its future performance.

Backtesting can be done using a variety of methods, including manual analysis of historical data or automated software programs that simulate past market conditions.

It’s important to note that while backtesting can provide valuable insights into the performance of a particular investment strategy or trading algorithm, it’s not a guarantee of future success.

Which tools help with backtesting?

- MetaTrader: MetaTrader is a popular trading platform that includes a built-in backtesting tool. The platform allows users to test and optimize trading strategies using historical data, and also includes a range of other features such as advanced charting tools and real-time market data.

- TradeStation: TradeStation is a comprehensive trading platform that includes a powerful backtesting engine. The platform allows users to test and optimize trading strategies using historical data, and also includes a range of other features such as advanced charting tools and real-time market data.

- Amibroker: Amibroker is a popular technical analysis and trading platform that includes a built-in backtesting tool. The platform allows users to test and optimize trading strategies using historical data, and also includes a range of other features such as advanced charting tools and real-time market data.

- Quantopian: Quantopian is a web-based platform that allows users to develop, test, and deploy trading algorithms. The platform includes a powerful backtesting engine that allows users to test their trading strategies using historical data, and also provides access to a range of other tools and resources.

New YouTube Video – Trading Strategies with Jim Matthews

I returned to doing a YouTube video interview last week with JJMStocks, or Jim Matthews. It was an enlightening conversation for 20 or so minutes.

We covered:

- How he go into trading / investing?

- Does he day trade, swing trade or invest for the long term?

- What are his favorite tools? Which is his go to charting solution?

- What is his trading strategy?

- How does he manage his emotions?

and more.

What does a series A funding strategy and plan look like?

This post is the first in a series that I am planning to do on fund raising. I have successfully raised money 3 times (to a total of $29 Million – series A, B and C) and failed twice (once trying to raise $2 Million series A and second time $3-$5 Million series B).

As a background please read Elizabeth’s great post on “Behind the scenes of a seed round”.

Fund raising is one of the most difficult parts of a founder’s job. Getting money from investors of any type is hard. Dont be fooled by stories of entrepreneurs talking to investors and getting checks in 10 minutes. Those are truly black swan events.

The first thing you have to realize is that you need to develop an comprehensive plan and strategy to raise your series A. Think of it as an effort that’s similar to the launch your product. For purposes of this discussion lets call series A, as your first institutional round. I am also making the assumption that you have a working product, paying customers and are targeting a very large market (>$1 B for US, >$250M in India). If any of those criteria are not met, dont bother trying to raise money in this environment.

What are the 3 most important elements of your funding plan?

1. The pitch deck – a 15 slide PowerPoint presentation which summarizes the market, problem, traction and investment requirements. This is needed only for the face-to-face meetings.

2. The target list of potential investors – a Excel spreadsheet which has investor’s firm, name of partner, list of 2-3 recent investments (in the same general space as yours), email addresses, phone numbers, admin assistant’s name & email address, investor connection (people who can give you warm introductions to the investors), status and notes fields. You could use a CRM tool like Zoho if you like, but its overkill for this purpose is what my experience tells me.

3. An email introduction (40 – 100 words) and a one page summary. A simple text file with no images or graphs (something that the investor can read on their mobile phone (most have blackberry, although that’s changing). This can be sent to your connections to introduce you to investors or directly to known investors.

What should your strategy be?

1. Who should you target by role?: Investment firms have partners (decision makers) and associate / principals (decision enablers). Partners make decisions so if you can, get a introduction to a partner. If you cant, its not all doom and gloom, since many partners rely on their associates and principals to source deals for them.

2. Who should you target by investment thesis: Every investment firm has an investment thesis (how they will deploy funds to get best returns for their investors). This should guide you as to whether you’d be a good fit for the firm. Example: An investment firm might say we believe India’s broadband access and huge number of consumers with high disposable incomes is a great target for Indian eCommerce companies. So, they will deploy a certain % of their funds in eCommerce companies. Similar theses exists for big data, SaaS, etc.

Example: if you are an education startup focusing on India, Lightspeed (thanks to their success with TutorVista) should be on the top of your list. If you are a SaaS firm targeting US, Accel (thanks to Freshdesk) should be on your list. If you are a travel technology startup, Helion & Saif (thanks to Make My Trip) should be obvious targets.

A word of caution: If a firm has invested in a company in your sector, they will very likely ask you to speak to the CEO of their portfolio company to perform cursory due diligence. You may decide that company might be competitive and likely to execute your idea better since they have more resources. So proceed with caution and dont reveal any thing during your due diligence that might hurt you later.

Many investors invest in a sector because they “need one of those in their portfolio”. Example: Every firm has a baby products eCommerce company. So, I also recommend the “herd rule”. Which means, you should talk to other investors if your competitor has been funded by your first choice investor.

3. Who should you target by investment stage: Although every Indian investor claims to be sector agnostic and stage agnostic, there are a few early adopter VC’s. If you are the “first” in a new space, then consider an early adopter investor, else any investor who has not made an investment in the sector will suffice.

In a next post I will outline what the series A funding process should look like. This post will include information about whether you should follow a “back-to-back” process, or do a “listen and tweak” process.

If you like this post, please consider submitting to Hacker News.